Blackstone – Reality Bites

To download a PDF version of this update, click here.

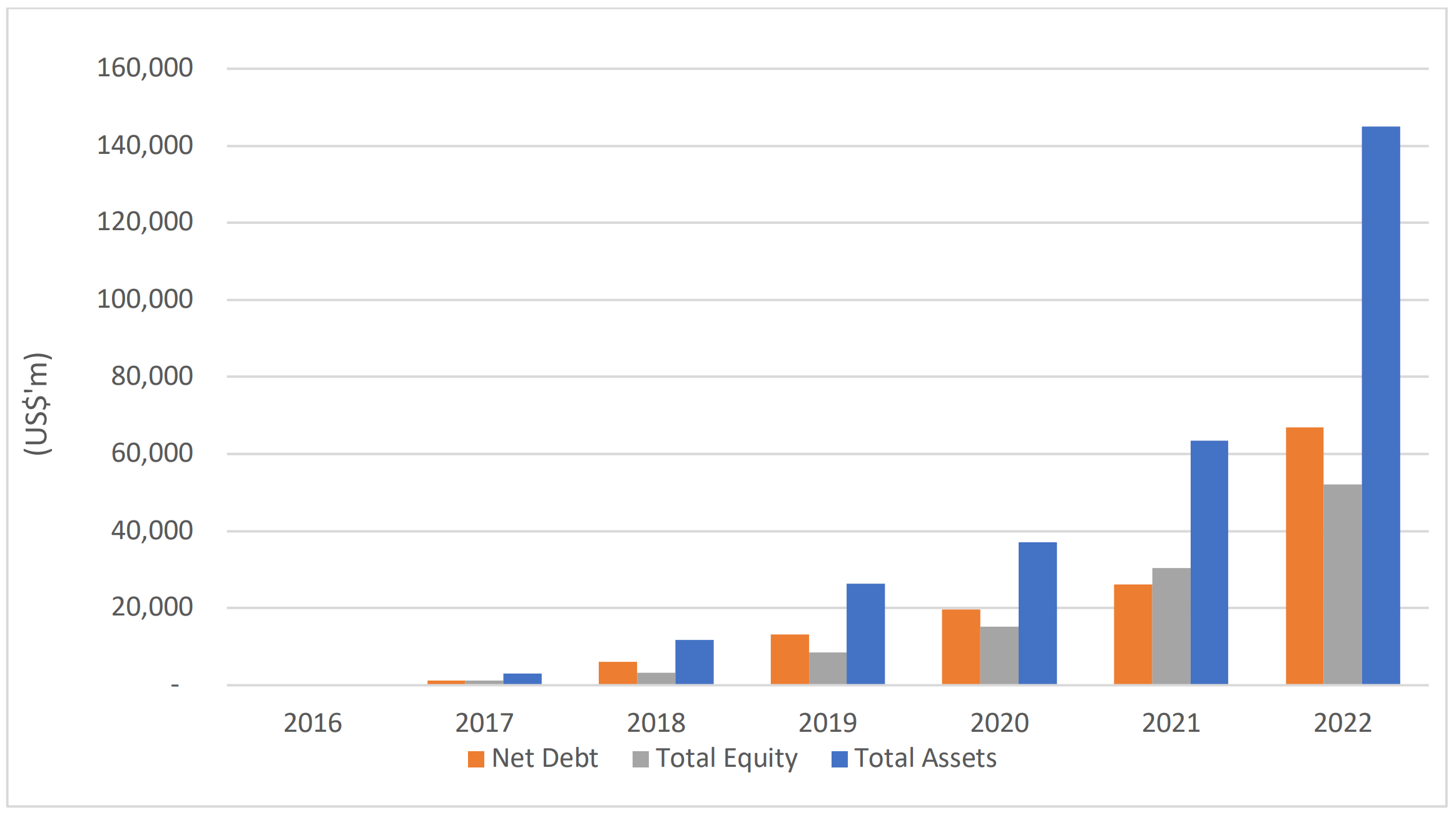

Recent news that Blackstone, a major private equity funds manager, has restricted investor redemptions from the flagship Blackstone Real Estate Income Trust (BREIT) has created a stir in real estate and funds management circles. BREIT is the largest open-ended non-traded/unlisted property fund in the US, investing in a range of US commercial real estate sectors. As at 30 September 2022, the value of the fund’s assets was appraised at US$145bn, the majority invested in residential rental properties (~60%) and logistics facilities (~19%). BREIT amassed the portfolio in a little over a 5-year period.

BREIT – Growth Envy

Source: Blackstone, BREIT company documents

Source: Blackstone, BREIT company documents

Soon after the BREIT redemption restriction news made headlines, Starwood Real Estate Income Trust, the second largest unlisted US real estate fund, announced that it too would limit redemptions.

What these redemption restrictions suggest is that there is a broad-based pause, if not a reversal, in the massive flow of funds into private real estate markets experienced in recent years. This perhaps serves to reinforce our belief that the real estate cycle is beginning to change its trajectory after a multi-year upswing, and that most appraisal based private real estate valuations are not representative of changes to market investment hurdle rates. More pointedly, private real estate values should fall. The news also should serve as a reminder of the risks for all investment options which provide immediate liquidity from underlying inherently illiquid assets such as commercial real estate.

In light of changing monetary policy settings, increased economic uncertainty and weakness of many major public investment markets, the news should not come as a complete shock1 . In recent months, a number of open-ended UK unlisted property funds were forced to “gate” redemptions, albeit in response to particularly challenging local economic conditions2. Indeed, looking back over the past 30 years there is a pattern of unlisted funds suspending redemptions coinciding with economic disruptions including during the GFC, the fall-out from BREXIT and most tellingly the property crash of the early 1990’s.

Given Blackstone’s high profile, we thought it would be worthwhile reviewing the reasons openended unlisted property funds face this recurring problem, highlight some of the specific risks for fund investors and offer some thoughts as to how they might be resolved.

First some basics. “Open-end funds” offer investors the ability to redeem units typically monthly, albeit usually subject to some size limits3 . In an “orderly” market, the manager pays an investor’s redemption request from a combination of sources, including: matching inflows from new investors; from the fund’s existing cash reserves; or by increasing debt. In periods of elevated redemptions, the fund may also sell some of its real estate assets, again assuming the market is orderly. The redemption (and application) price of unlisted funds is determined by periodic appraised valuations of the underlying investments, typically conducted by independent third-party valuers. These valuations are typically conducted annually but may be conducted quarterly.

In periods of rapid financial dislocation, appraised values are likely to lag real-time market values, because transaction volumes decline leaving valuers with little evidence to support their appraisal.

This has been the case in 2022, as the rapid shift in monetary policy settings triggered many property investors to put their proverbial cue back in the rack, particularly since June as the US Fed made abundantly clear its restrictive monetary policy settings. From a buyer’s perspective, their higher cost of capital today commands a lower property price (a higher cap rate) for the investment return to pencil, all-else-equal. Hence today, there is said to be a wide gap in the buy/sell spread (if, in some cases, there is any bid at all). Consequently, with no hard evidence of transactions to guide valuers, unit prices of many unlisted property funds have remained relatively stable.

At the same time, publicly traded asset classes such as bonds, equities, and more relevantly listed REITs, have suffered significant price declines as investors actively reappraise value and search for liquidity.

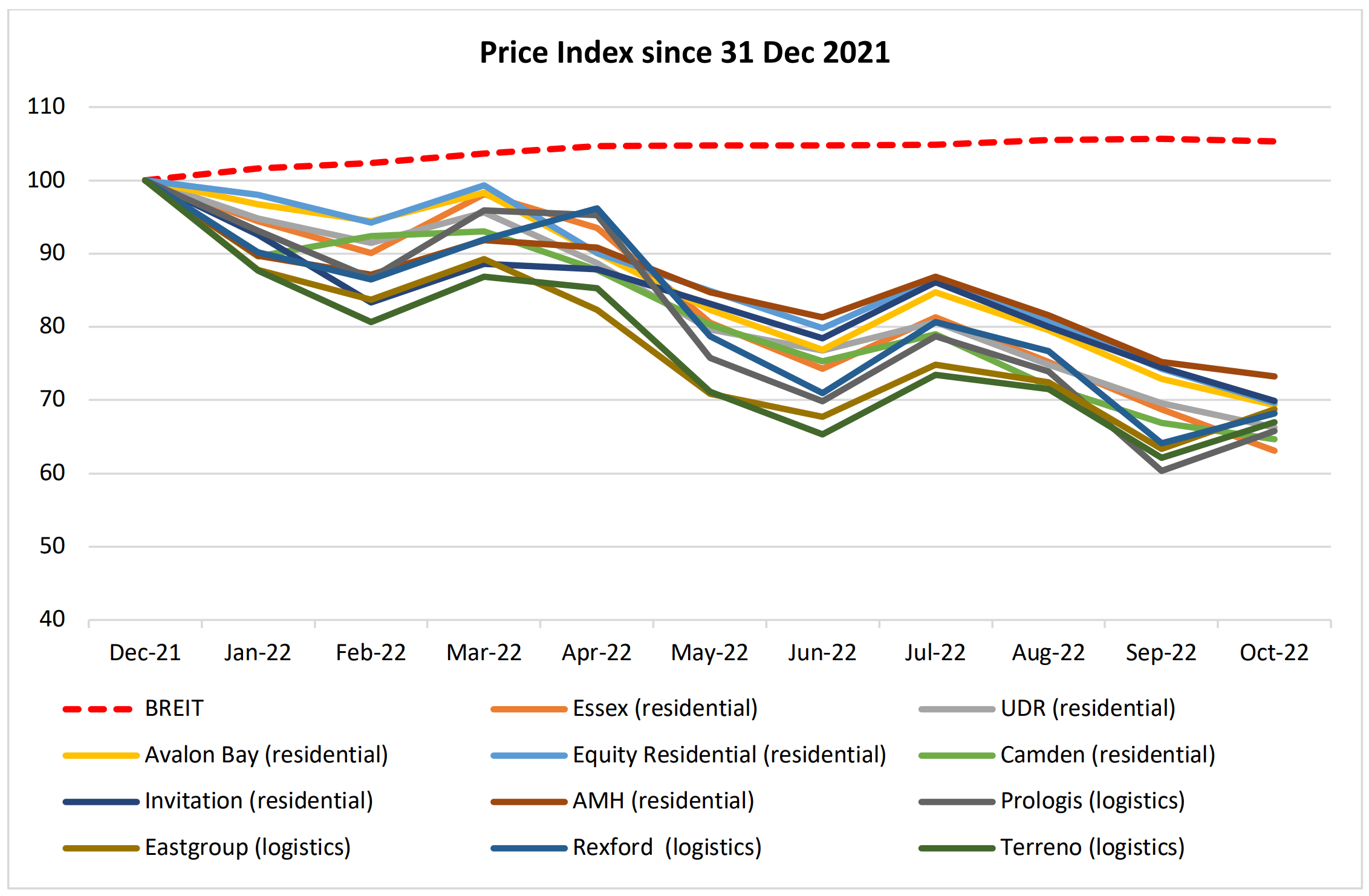

BREIT Share Class I asset value per share versus share prices of listed REIT peers

Source: Blackstone BREIT Class I, Bloomberg, Factset

Source: Blackstone BREIT Class I, Bloomberg, Factset

As can be seen in the chart above, the unit price of BREIT, like many other unlisted real estate funds, has changed little over the past 12 months. In our view, it is likely that today’s values of the underlying real estate assets in unlisted funds have in fact been negatively impacted by the substantial rise in the cost of capital and sudden change in the investment climate this year. As Benjamin Graham wrote in his esteemed tome The Intelligent Investor; “it is self-deception to tell yourself that you have suffered no shrinkage in value merely because your securities have no quoted market at all.”

The spike in redemptions experienced by Blackstone and other unlisted real estate fund managers suggests that investors are either coming to this same conclusion, or simply selling their winning investments to redeploy in better value or safer investments elsewhere in reasonable expectation that the value of their unlisted investments can’t defy gravity indefinitely.

Hence, given the downward pressure on asset values and limited ability to sell property assets in an orderly fashion, BREIT management found itself with little choice but to ‘gate’ the fund (the polite way of saying freeze unit redemptions) and investors have their equity capital effectively locked in4 . At this stage the redemption requests appear to be relatively modest. However, subject to broader economic and investment market conditions, it is quite conceivable at this point, that the queue for redemptions will extend into 2023. Illiquidity begets illiquidity.

Unlisted property managers and the real estate appraisers might argue that these circumstances are temporary and that the underlying operating dynamics of their portfolios are intact. If true, the logical conclusion must be that publicly traded REITs, which have experienced a sharp sell-off this year, are cheap relative to the unlisted funds, but we will come back to this later.

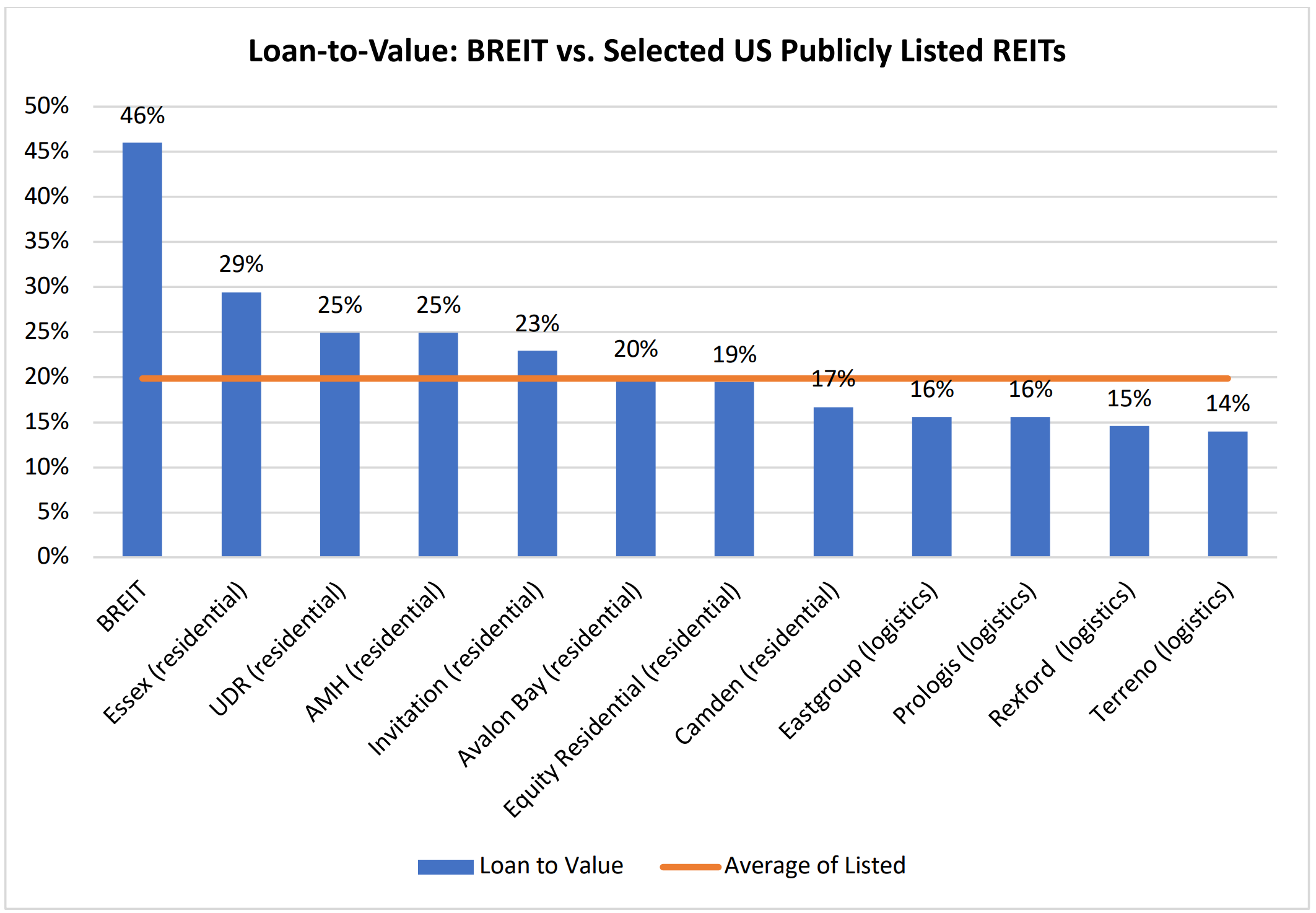

Making matters more challenging, some unlisted property funds have elevated levels of financial leverage. Indeed, BREIT’s Loan To Value (LTV) equated to at least 46% at 30 September 20225 . We estimate the LTV for comparable US listed REITs is less than 30%.

BREIT Loan to value versus peers

Source: https://www.breit.com/performance, Listed REIT loan to value using ResCap estimated gross asset value

Source: https://www.breit.com/performance, Listed REIT loan to value using ResCap estimated gross asset value

So, what next for BREIT?

Clearly much depends on broad investment market conditions and the strength of the economy. Given real estate operating conditions appear to be generally balanced and credit markets remain open, barring extremes in interest rates and/or the economy, it is reasonable to expect BREIT should be able to stabilise the situation through further asset sales6 . However, given the risk of ongoing central bank policy error and the fund’s high leverage, this is far from a certainty.

Blackstone is the proverbial market maker for BREIT, and investors are unlikely to have a ready path to liquidity from behind the gates. Should unlisted investors be unable to redeem their units directly for an extended period, they can attempt to find another buyer of their units in what is referred to as a “grey” or “secondary” market. However, unit transfers often take place at a discount to the published official stated unit value (sometimes but rarely at a premium, typically when real estate values are accelerating).

If redemptions persist and transaction activity remains subdued, one solution would be to seek a listing of BREIT on the stock market thereby circumventing the freezing of redemptions or forcing sellers to form long queues to find buyers in unregulated grey markets. In fact, this was the avenue that unlisted property trusts were forced to take in Australia in the early 1990’s. However, this would be a major loss of face for Blackstone and a sign of deterioration of broader market conditions.

BREIT could significantly devalue the assets, by selecting more conservative independent appraisers, reflecting arguably more accurate valuations. This might discourage investors from redeeming at a “fairer” price and encourage applications from new investors. However, it would create another set of problems including the risk of breaching debt covenants and the possibility of litigation from investors aggrieved by superior terms recent sellers have obtained and Blackstone’s excessive management fees.

Barring a public listing, these scenarios do not address the fundamental issue that many private real estate funds need to periodically freeze redemptions when unexpected events threaten valuations.

Of course, advocates of unlisted real estate funds will argue that investors know that the funds can be periodically closed for redemptions and the listed market is more volatile. In our view volatility is at least partly the price of liquidity, and it is up to investors to decide which they value more highly. The insult is that the listed REIT volatility is sometimes accentuated by the inability of the investor to sell their unlisted investments, thereby forcing them to sell what they can to rebalance portfolios. Hence, the lack of liquidity of private real estate funds causes sub-optimal portfolio construction decisions which is ignored in measuring these distorted returns7 .

What does it mean for Listed REITs?

We reiterate liquidity has a price. Given the extraordinary uncertainty associated with the outlook for interest rates and economic growth, those investments which can’t provide liquidity can simply offer a best guess on value.

Given their sell off this year, whilst the benefits might seem hard to solemnise, listed REITs are demonstrating the effects of their liquidity.

Whilst we aren’t privy to the finer details of unlisted property fund valuations, based on easily observable market data it is obvious that many high-quality listed REITs with strong balance sheets (in which we typically invest) are trading at 15-30% discounts to unlisted property funds investing in similar property types.

This listed versus unlisted arbitrage opportunity, in favour of listed, presents a key challenge for BREIT and its cohort of open-end unlisted funds to retain existing let alone attract new equity investors: why invest in a vehicle facing significant challenges on outdated valuations when one can buy underlying comparable quality real estate, with stronger balance sheets, lower management expenses, and daily liquidity and trading at a material discount? Surely the cheerleaders stock answer that unlisted provides “lower volatility” has lost resonance.

The debate of the merits of listed versus unlisted property has been taking place for decades, BREITs situation lays bare the flaws in the arguments for unlisted real estate.

But for us the significance of the news is: 1. The respite in flows into private real estate funds provides evidence that the cycle has turned, and values are under meaningful downward pressure; and 2. that listed real estate, in which ResCap only invests, is far superior value to that of unlisted property funds.

1 Indeed, we highlighted the risks facing BREIT in our September 2022 quarterly report and have variously covered the topic of unlisted real estate funds freezing redemptions over the years

2 For example, Legal & General Investment Management removed monthly trading for large investors in its £3.7 billion Managed Property Fund and M&G has deferred redemptions from its £4.6 billion Secured Property Income Fund.

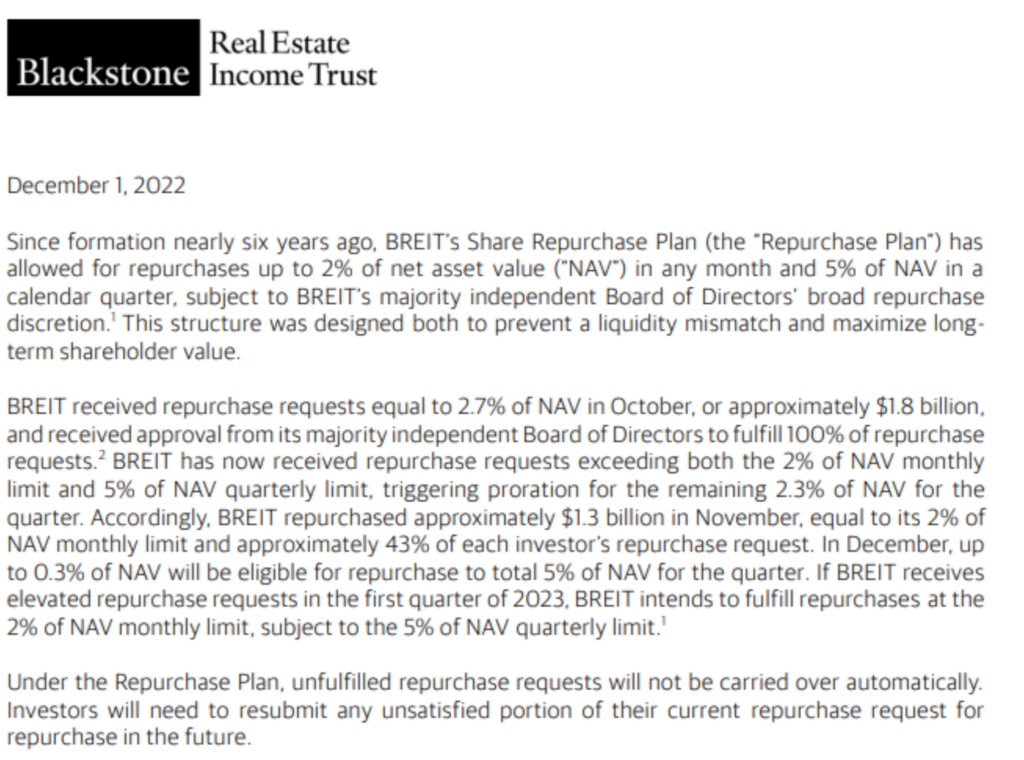

3 In BREIT’s case, the fund allowed for 2% of total assets to be redeemed by clients each month with a maximum of 5% per calendar quarter

4 Sensibly, BREIT already gates redemptions, allowing only 2% per month or 5% per quarter to be redeemed, subject to Board approval. Nevertheless, Blackstone’s disclosure that it has received redemption requests in excess of both these limits in November 2022 marks a significant reversal of a multi-year inflow trend.

5 In our opinion BREIT will almost certainly need to materially reduce its financial leverage limits.

6 In November BREIT sold interests in Las Vegas casino properties for US$1.27bn at a healthy premium to book value, albeit it raises questions about selling crown jewels

7 Imagine if we advised clients: we won’t allow you to redeem your units from the Resolution Capital Global Property Securities Fund (Managed Fund) because the stock market is too weak, we want you to wait for prices to recover to fair value.

Disclaimer: