Global REITs: Out of favour, but rarely better!

Andrew Parsons, CIO, Resolution Capital

To download a PDF version of this update, click here.

The narrative on Global REIT price weakness in recent years has centred on the rapid rise of interest rates, headlines about the demise of the office, and concerns about the health of bank lending to commercial real estate. Whilst there is merit to some of these concerns, they mask the reality of a listed real estate sector in strong shape. While there are pockets of stress, broad real estate operating conditions are favourable, and Global REITs (G-REITs) feature many best-in-class operating platforms. With lower financial leverage, well-laddered debt maturities and diverse sources of capital, G-REITs are well placed to withstand broad economic challenges and indeed to thrive from any duress facing private sector real estate owners.

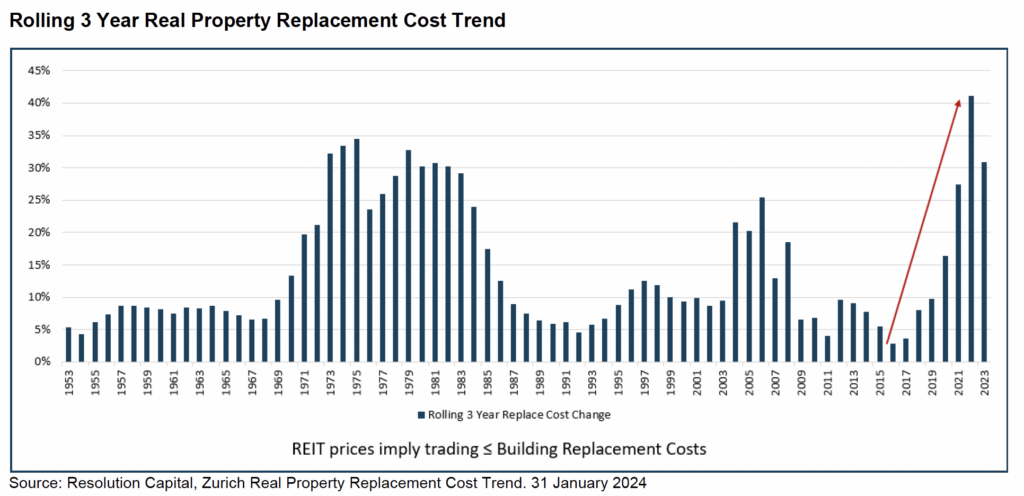

Crucially, the market is missing an important dynamic that should serve to underpin G-REIT values, or at least serve as a means of effective portfolio diversification. Thanks to materially higher construction costs over the past 3-5 years, combined with overall commercial real estate and REIT share price weakness, many REITs are trading at or below replacement costs. Hence, it can be argued that REITs are trading at intrinsic value.1

The overall commercial real estate operating environment is quite healthy with low property vacancy rates and limited and/or declining new building supply. Furthermore, thanks to materially higher construction costs, tighter lending conditions given challenges in the banking sector, and higher investment hurdle rates, new development is uneconomic at current rent levels.

Hence, subject to the extent of economic growth, we believe the foundations are being laid for sustained real rent growth with segments of the commercial real estate market facing chronic undersupply conditions in the medium term. Indeed, commentary from a growing number of REITs points to their ability to exert pricing power in lease negotiations.

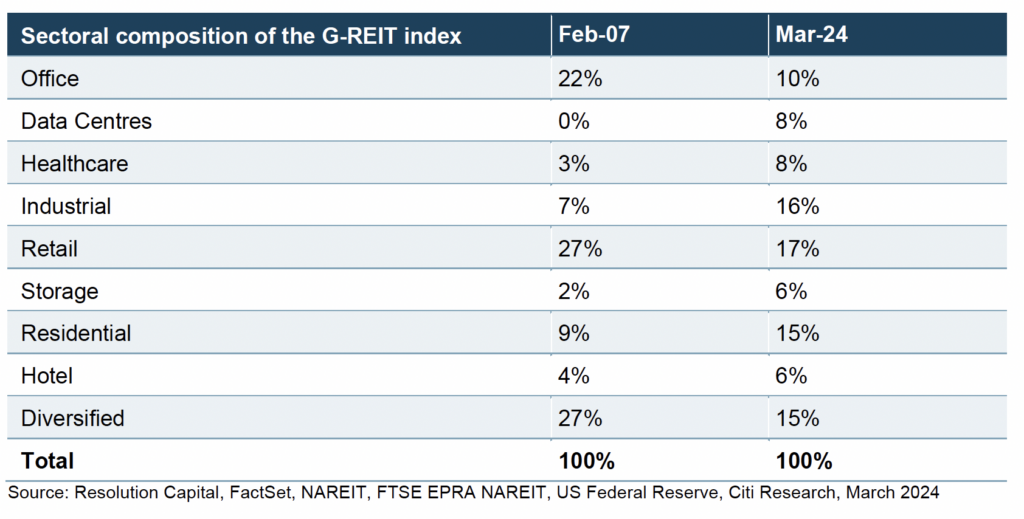

Of course there are exceptions, for example owners of low-quality office face a particularly challenging period thanks to a realisation their buildings are effectively obsolete. That said, office REITs with superior quality properties are taking meaningful market share and record rents are being achieved in select markets. Furthermore, we highlight that over the past 20 years the office sector has shrunk to less than 10% of the global REIT benchmark2. In its place, as highlighted in the table below, are sectors such as data centres, healthcare and logistics that are benefiting from long-term secular growth trends.

Doing the Math on Property Values, Economic rent and Intrinsic Value

It is important to understand the interplay between building costs, property values and economic rents.

Since peak values were set around the eve of COVID-19, Commercial Real Estate (CRE) values have fallen by an estimated 10-20% on average. It should be noted, there is a wide range (perhaps -60% to flat) across sectors, and low commercial real estate transaction activity makes the assessment more challenging.

What should not be overlooked is that over the past 5 years construction costs have risen by an estimated 30-40%, indeed, growing at rates not seen since the 1970s.

With falling values, higher costs and market rents generally not keeping pace with building cost inflation, this sets up a very unusual dynamic for real estate and REITs, particularly in light of historically modest vacancy rates.

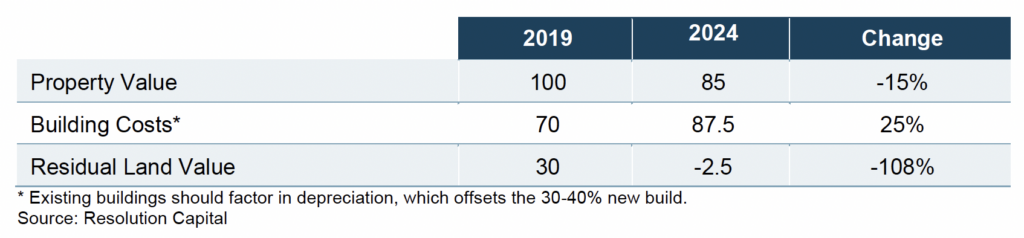

In simple terms and at its core, the value of a property can be split into the building costs, which are broadly quantifiable in terms of bricks and mortar, labour, design and entitlements and finance. The swing factor is the land value which is typically the residual of a property’s market value less the build cost, which should also take into account a developers profit margin of typically 15-25%.

Historically, land value tends to represent an average of around 25-30% of a property’s total market value, although this can vary by location, property type and building density.

We can see how this has played out theoretically in the following model which suggests real estate, and REITs in particular, are now trading at “intrinsic value”. In other words, REIT prices are supported by replacement cost with limited if any value ascribed to land.

Office property is the most obvious to have suffered the greatest impact. In some instances, office land can be viewed as having negative value, as shown in the portrayed model above. In some cases, this can be fair because of obsolescence, elevated vacancy and the hold costs likely to be incurred on sites for which there may not be sufficient occupier demand for several years, and/or the considerable costs to convert the site to alternate, more attractive uses.

This should also serve as a warning to be wary of developers who amassed undeveloped land holdings in the throes of the QE/low interest rate environment. Land probably is not worth today what was paid for it in the past 5 years.

It should be noted that in the limited cases where development is currently taking place, such as logistics warehouses, self-storage, data centres and U.S. sunbelt apartments, either:

a. Market rents have increased materially in response to outsized demand;

b. Developers have a low land cost base, which might be the case if they are long term owners with a low historic cost base; and/or

c. They have had the benefit of rezoning/densification entitlements, and in the case of data centres, access to incremental electricity power supply.

However, we note that logistics and sunbelt apartment new starts are now in decline and substantially lower than peak levels.

This tells us it will be some time before we see meaningful new development despite low vacancy rates unless we see a very sudden and material increase in rents and/or a very meaningful tightening in real estate cap rates to drive up real estate values.

Balance Sheets in a Balanced State

Increasing our conviction about G-REITs is that they are by and large in strong financial shape. This is a topic we have covered extensively in our recent quarterly reports. Suffice to say, a large number of REITs, particularly in the U.S. where the majority of our portfolio is invested, have historically low leverage and well laddered long dated debt. With many enjoying investment grade ratings, these REITs able to access capital markets where the majority of borrowings come in the form of unsecured bonds. Putting it differently, unlike private players, many REITs do not rely upon bank debt. Please see the improved capital position in our Post Script section below.

It all comes down to Intrinsic Value

With higher interest rates factored in, rental income levels seemingly stable, and finance available for REITs, we think it’s fair to suggest sector values are close to trough, with the caveat that any economic contraction would ordinarily correlate with tenant demand. However, given the quality of the REIT platforms, low vacancy and strong balance sheets, REITs are well positioned to withstand more challenging conditions in a relative if not absolute sense.

In summary:

- PRICES HAVE CORRECTED, as the market has factored in a world post QE and “old-normal” interest rates.

- REITs enjoy a SUPERIOR CAPITAL POSITION and BEST IN CLASS OPERATING PLATFORMS.

- Development is not economic, so the prospect of SUPPLY GROWTH IS LIMITED.

- Low overall vacancy rates indicate REITs are positioned to enjoy PRICING POWER in terms of rental growth.

- REITs are priced attractively AT INTRINSIC VALUE based on replacement costs.

Consequently, it is our belief that G-REIT valuations are relatively, if not absolutely, attractive, often trading at a discount to private market real estate values as well as at, and in some cases, below, replacement costs. Hence, as a store of wealth with a growing income stream, G-REITs should be a positive contributor to portfolio diversification.

Post Script – “Could you ever love me again?”

It could be fair to say that REITs have been caught up in the growth over value trade which is dominating equities markets.

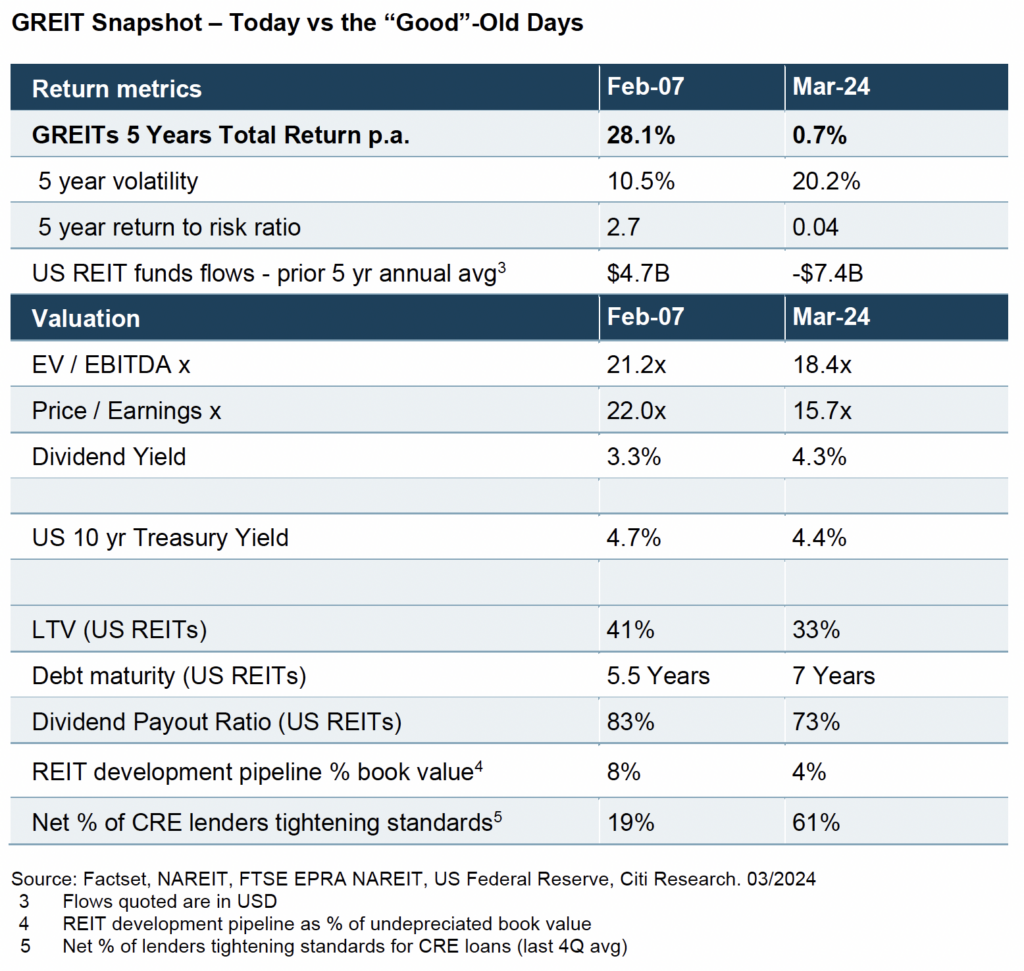

With credit for our post script title to Gary and Dave’s 1973 melody, we think it is interesting to compare today’s poor sentiment regarding REITs with the last time we consider the sector was truly in favour. In our experience we believe this was in the period after the dot-com bubble burst in the early 2000s through the lead up to the Great Financial Crisis which began to unfold in late 2007.

As the following snapshot highlights, in 2007 REITs enjoyed a premium multiple, strong returns and sizeable inflows despite the sector’s growing risks around capital management (leverage, development exposure, dividend pay-out ratio) and elevated new building supply in the broader real estate market.

We expect today’s sentiment will turn for the better, albeit it seems patience may continue to be tested.

REITs, unloved as they seemingly are today, are better positioned across a range of metrics that matter including capital structure, earnings valuation and cash.

1 Intrinsic value by our definition is the objective cost of building. Whilst well located land naturally has value, the cost of producing land is difficult to determine. Its value is typically defined as a property’s end value less the cost of building to derive a residual land value.

2 FTSE EPRA NAREIT Developed Index

Further information

Contact Resolution Capital Client Services team at clientservices@rescap.com

Disclaimer:

This communication is prepared by Resolution Capital Limited (‘Resolution Capital’) (ABN 50 108 584 167, AFSL 274491). Pinnacle Investment Management Limited (ABN 66 109 659 109, AFSL 322140) and its associated entities (collectively ‘Pinnacle’) provide distribution and responsible entity services to Resolution Capital.

Resolution Capital and Pinnacle believes the information contained in this communication is reliable, however, no warranty is given as to its accuracy and persons relying on this information do so at their own risk. This communication is general information only and does not take into account your objectives, financial situation or needs. Any persons relying on this information should obtain professional advice before doing so and consider the appropriateness of the information having regard to your specific circumstances. To the extent permitted by law, Resolution Capital and Pinnacle disclaim all liability to any person relying on the information contained in this communication in respect of any loss or damage (including consequential loss or damage), however caused, which may be suffered or arise directly or indirectly in respect of such information. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Resolution Capital.

Resolution Capital is an affiliate of Pinnacle Investment Management Ltd. Pinnacle Investment Management (UK) Ltd is an appointed representative of Mirabella Advisers LLP (FRN 606792), which is authorised and regulated in the UK by the Financial Conduct Authority.