Resilient REITs: Unlocking through-cycle outperformance

Global listed property provides investors with exposure to the underlying returns of some of the world’s best property. It’s property very few investors can access directly, and the opportunity set is large.

Outside of apartments , offices and shops, there’s a multitude of property types in the global listed real estate sector offering different income and return profiles and providing portfolio diversification benefits.

REIT earnings profile less volatile

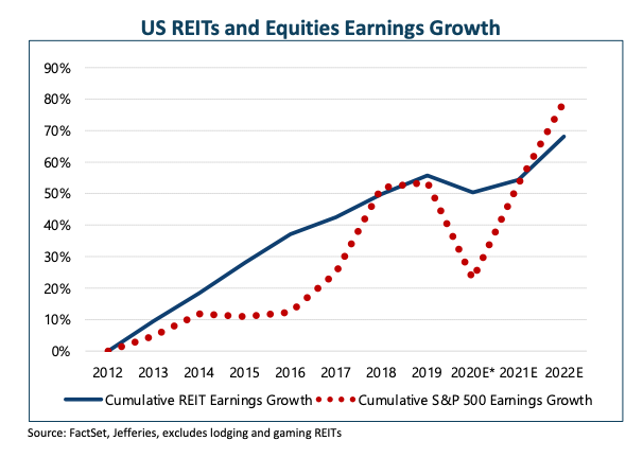

Despite a significant level of hyperbole surrounding property during the height of the COVID-19 pandemic, REIT earnings have proven to be much more stable when compared to broader equities. The chart below illustrates this earnings strength by comparing cumulative US REIT earnings growth to cumulative earnings growth in the S&P 500.

The impact of the pandemic on REIT earnings was blunted by the long term leases in place in many commercial properties and the fact that property supply was already below historic averages in most sectors prior to the onset of the pandemic.

Furthermore, during a period when we heard much about rent stress, we now know rent collection rates were better than feared. In the Resolution Capital portfolio, 94% of REITs held or increased dividends through the pandemic.

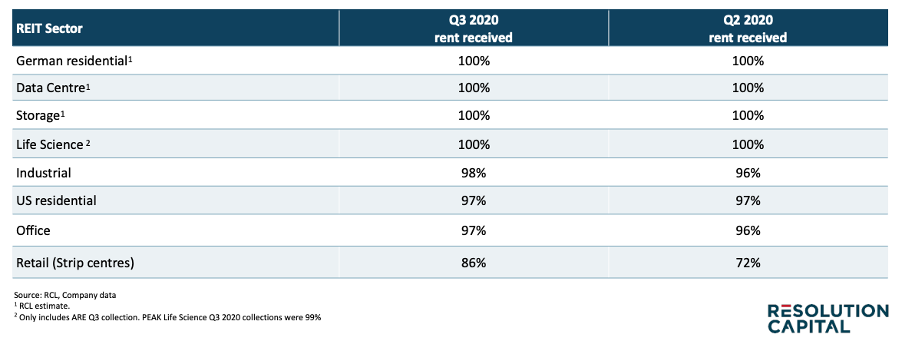

The table below summaries the rent collection rates for various REIT sectors based on company data and estimates.

Not surprisingly at the bottom end of the table we see the office and retail sectors. The retail sector in particular was hit hard with tenants unable to occupy stores and record store closures. Both the office and retail sectors remain structurally challenged in our view, but overall rent collection for the REITs remained reasonably strong throughout the ultimate stress test of the pandemic with rolling shut downs.

The pandemic legacy – trend acceleration

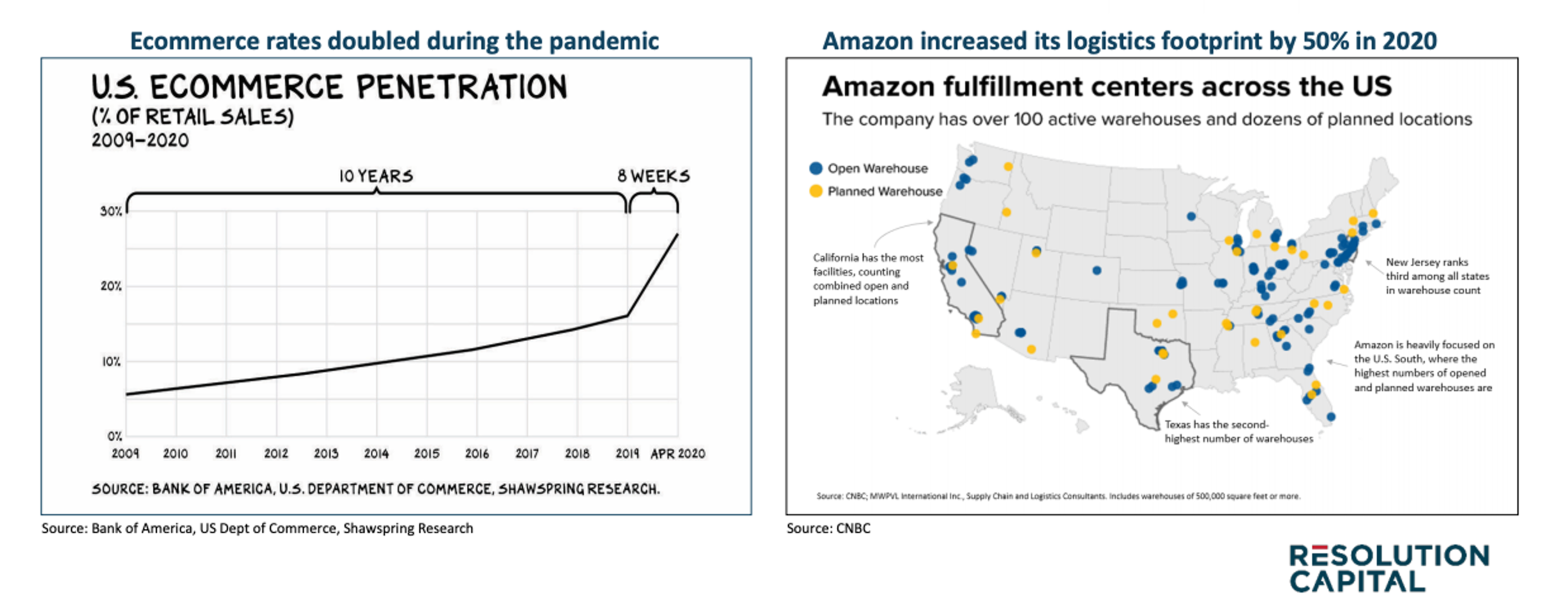

Trends toward digitisation and ecommerce have seen a material acceleration as a result of the pandemic. This has strengthened demand for logistics, data centres and cell tower REITs.

When it comes to logistics, the rapid acceleration of ecommerce during the pandemic has been well documented. So, what was the impact on the property used by the world’s largest retailer, Amazon? It increased its logistics footprint by 50% in just 12 months – that’s half of Walmart’s distribution network which was developed over 50 years!

This rise of e-commerce vs traditional retail is driving an increasing demand for distribution centres. According to commercial real estate giant CBRE, every $1 billion in e-commerce sales will equate around 1.25 million square feet of distribution space. Underpinning this expansion are property groups that offer retailers like Amazon critical strategic warehouse assets and at the other end, offer investors exposure to long term growth and earnings resilience.

One such REIT is San Francisco-based, Prologis. Prologis is one of the world’s largest logistics landlords and a key holding in the Resolution Capital portfolio.

When it comes to Data Centres and Cell Towers, demand for capacity continues to grow, with the pandemic conditions only serving to reinforce the trend for people and businesses to move online.

NASDAQ-listed REIT Equinix is a world leader in network-dense data centres – think of these as modern-day telephone exchanges that are critical for the effective functioning of the internet. Not surprisingly, EQIX has benefitted from the acceleration in data demand caused by the pandemic.

Another sector we have long been attracted to is the life-science office segment. Strong demand conditions existed even before COVID-19, driven by an ageing population, increased healthcare spending and enthusiastic venture capital funding. The task of tackling unsolved complex human diseases has a long runway in our view – and is increasingly being addressed using talent from both technology and medical science often found clustered in knowledge-based markets such as Boston, San Francisco, San Diego and Seattle.

The rapid development of several effective COVID-19 vaccines is no doubt in part due to the enormous funding and effort put towards the same cause. Perhaps unsurprisingly, there has been a significant increase in capital focusing on the life science office sector.

One of our top portfolio holdings has been U.S.-listed Alexandria – a leading owner and developer and the only pure-play listed REIT focused on this sector.

Is now the time for listed property?

Global listed property is arguably a quiet achiever in an investment universe where high profile equities continue to steal the headlines. However, on a long term time horizon, total returns of global REITs remain very competitive and have delivered a higher income return than equities.

Despite this competitive long-term performance and the earnings resilience displayed by the sector during the recent pandemic, the REIT sector has not rebounded as strongly as equities and REIT multiples today are trailing broader equites.

With the rollout of the vaccine and reopening of economies in 2021, we believe global listed property offers both cyclical and secular investment opportunities, but careful stock selection is necessary.

Our three key areas of focus when identifying REITs;

- Resilient cash flows that can grow through time

- Robust balance sheets with low leverage

- Aligned management teams

The global listed property sector has evolved substantially over the past 10 years, providing access to digital infrastructure and other alternative sectors. Given the current the backdrop of low to moderate supply and strong balance sheets, we believe a diversified portfolio of listed property investments provides investors with liquidity and a resilient return profile.

Disclaimer: