We (didn’t) Work

To download a PDF version of this update, click here.

In another blow to the office sector, WeWork, the global flexible workspace provider, has declared bankruptcy and initiated a re-organisation to strengthen its capital structure. The company aims to further rationalise its commercial office lease portfolio, rejecting 69 office leases in North America (predominantly in New York and San Francisco) while continuing to operate most of its locations outside of the U.S.

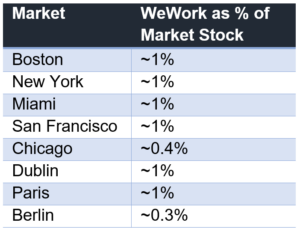

As of 30 June 2023, WeWork had a network of 777 locations in 39 countries around the world, leasing approximately 43.9 million sqft. Estimates put WeWork as percentage of total office inventory at ~1% in key global office markets.

Source: WeWork, 2023

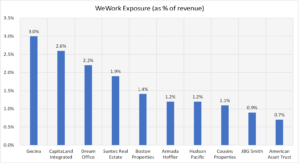

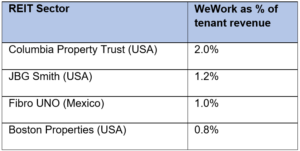

WeWork has already been in decline for some time, and as such we do not view the consequences for office REITs as overly concerning. Only a few listed REITs have more than 2% direct exposure to WeWork as a tenant. In the case of Gecina (GFC), which has the largest exposure at 3%, its WeWork exposure is located in central Paris where the market vacancy rate is 2.0% and in Singapore where Capitaland Integrated has exposure, the market vacancy rate is 4.3%.

WeWork is not listed in the top 10-15 tenants of any holdings in Resolution Capital’s Global REIT portfolio.

Listed Office REIT’s Disclosed Exposure to WeWork (% revenue)

Source: Resolution Capital, November 2023

Nevertheless, the bankruptcy is another blow to the already struggling office sector, and a stark contrast to the heady days when Wework was expanding exponentially, fuelled by private equity venture capitalists pouring easy money into startups that were fundamentally poorly structured companies.

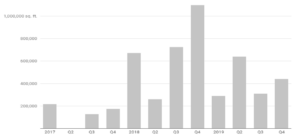

At its peak in 2019, WeWork was the largest single driver of office leasing demand in multiple cities across the globe and even surpassed JP Morgan as the largest occupier of space in New York city.

Space leased by WeWork in Manhattan each quarter

Source: Cushman & Wakefield, 4Q 2019

In our June 2018 quarterly report we wrote (excerpt below) about the rapid rise of co-working office operators, including WeWork, expressing our concern about the credit quality of such fast-growing and profitless companies with operationally leveraged business models that have a fundamental duration mismatch. At its peak, WeWork was valued at US$47 billion by its private equity backers, but an attempted initial public offering (IPO) in 2019 brought the scrutiny of public investors who disagreed with the value and were concerned about the company’s rapid expansion, it’s business model and apparent disregard for corporate discipline. This setback prompted the company to commence cutting costs and rationalising its space commitments. Adam Neumann, the founder of the company, also departed as chief executive, although not empty-handed after an exit package reported to be c.$500 million.

The company eventually went public in late 2021 via a SPAC1 with a market capitalisation of $8.5 billion which has since fallen to under $50 million at the time of its bankruptcy filing in November 2023. While the Covid pandemic, the shift to hybrid work and increased competition in the flexible office space industry all contributed to its de-rating, the Company’s demise was fundamentally rooted in its legacy long-duration leases which quickly became unsustainable as office vacancies surged and market rents declined.

As we wrote in 2018, industry incumbents have had a chequered past. Recognising the duration mismatch, industry stalwart IWG had long-ago mitigated that risk by predominantly signing leases on a non-recourse basis to the parent company (the founder often referred to the additional cost of running separate corporate entities for each location as an ‘insurance premium’ it was willing to pay to enable IWG to cancel leases when office market conditions deteriorated). At the time of its rapid expansion (and peak hubris), many office landlords (to their credit) demanded parent company guarantees when signing leases with WeWork. Ultimately however, WeWork’s bankruptcy leaves them in a similar position to those who are at the wrong end of IWG’s ‘insurance policy’. It is notable that IWG has since transitioned its business to an ‘asset light’ model akin to a ‘fee for service’ where it acts simply as the operator of serviced offices rather than committing to long term leases. In our opinion, neither model is ideal from an office landlord perspective, and investors need to price the risk of credit events appropriately where serviced office operators are a material exposure.

WeWork Share Price since public listing October 2021

Source: Factset, November 2023

WeWork reported a global occupancy rate of 72% as at 30 June 2023, a 300bps decrease from December 2022. North America is weaker at 68% compared to locations such as Paris at 83% and India at 78%. It is therefore not surprising that WeWork has so far rejected 69 leases in North America, as part of its bankruptcy filing, many of which were already not operational. The majority of the discarded sites are concentrated in New York City and San Francisco, cities that previously constituted a significant portion of the Company’s portfolio. It is anticipated that WeWork will continue to seek to reduce tenancy costs and renegotiate leases in more desirable locations that were signed at pre-pandemic higher rental rates, aiming for the more favourable market rates currently available.

WeWork’s downfall comes at a time when the office sector is already struggling with elevated vacancy rates and weak tenant demand, even before the impact of weaker macro-economic conditions begin to be felt more broadly across office-using industries outside of the technology sector. Add to that the imminent debt maturities expected to unfold in 2024-25 for highly-levered private office landlords, and the prognosis for the office sector looks particularly dire.

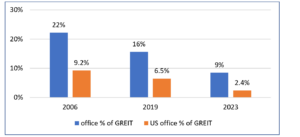

With this backdrop it would be easy to discard the entire office sector as un-investable. Indeed the listed GREIT market largely has, with the office sector representing only 10% of the FTSE EPRA Global Developed index, down from ~16% in 2019. Many US office REITs have declined by more than 50% from their 2019 levels and are trading at or below GFC multiples.

Public Office REITs as % of Global REIT Index

Source: Factset, Resolution Capital, November 2023. Note office sector excludes Life Science specialists Alexandra (ARE) and Biomed (BMR).

We also remain wary, with the Resolution Capital Global REIT portfolio maintaining an underweight exposure to the office sector. Nevertheless, we continue to monitor office REITs for select value opportunities, recognising the listed market has already factored in a lot of the negatives. Our select office exposures, representing approximately 6% of the portfolio, have sound balance sheets and are focussed in markets with relatively low vacancy rates such as London’s West End, and central Tokyo.

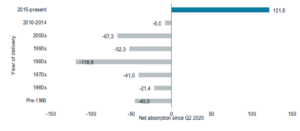

We note that even in a tough environment for the industry, select office landlords can win market share. The “flight to quality” has been a prominent theme gaining momentum since the pandemic as newer, amenity-rich buildings closer to public transportation have been capturing a greater share of the leasing market. It is expected that WeWork’s prime locations will remain operational, whether managed by WeWork or by other operators in the future. WeWork’s customers are unlikely to vanish, instead, many are expected to transition to other coworking operators or to take direct leases with landlords, who are likely to retain the extensive office fit-outs.

Net absorption by building vintage

Source: JLL, 3Q 2023

For those interested, we include below our thoughts on the rapid growth in the co-working sector that we penned for our June 2018 quarterly report.

Co-Working – Changing the Office Leasing Landscape

The way office space is consumed is evolving with technology and the rise of the share-economy as catalysts. One of the most significant drivers of office space demand over the past few years has been the co-working industry, traditionally known as ‘serviced offices’ or otherwise termed ‘flexible workplaces’.

According to JLL Research2, the co-working industry occupies over 51 million square feet of space across the U.S. as at the end of 2017, having grown by 23% per annum over the previous 7 years. In London 16% of all space absorbed in 2017 was by co-working operators.

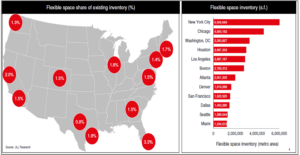

Despite its rapid growth, flexible space accounts for less than 2% of total office inventory in most major metro markets. Nevertheless, JLL projects that larger companies will embrace flexible working and by 2025 flexible spaces will account for 30% of the total footprint of larger organisations.

Flexible space share of total office: despite rapid growth, segment account for a very small proportion of total office stock

Source: JLL Research, 2018

As investors in office real estate, it is important to consider the implications of this new demand dynamic and its impact on landlords. There is healthy scepticism in the real estate industry of a business model that has long-term lease liabilities against short-term occupancy income. Certainly, the experience of traditional serviced office operators such as Servcorp (SRV) and Regus is cause for concern.

The co-working format is simple: the operator is a re-seller of office space. They typically lease space on a wholesale basis from the landlord on a conventional long-term lease, then fit out the space with a mixture of small office suites, open plan desks, meeting rooms, furniture and other amenities and then sub-lease (re-sell) the finished space to multiple customers who share common facilities.

Customers enjoy greater flexibility compared to leasing conventional space directly from the landlord, with shorter leases (often on a monthly membership basis), an ability to quickly expand or contract their space needs, and sharing overheads costs with other users.

Shared amenities typically provided by the operator include reception services, kitchens, catering and technology infrastructure such as printers, scanners, photocopiers, telephones, internet, Wi-Fi, and video-conferencing facilities. A larger membership base facilitates networking events and group purchasing power for everything from software, travel, healthcare and HR solutions.

The flexibility is particularly attractive to start-ups, freelancers, small-to-medium sized entities and is also an efficient way for larger organisations to initially establish new locations or take over-flow space for short-term projects. Many of these businesses often flourish in buoyant economic times and shrink rapidly when the economy slows, thus the business model is pro-cyclical. Moreover, operators face a duration mismatch with long-term fixed costs and shorter dated revenues driving operational leverage.

Established operators such as Australian-listed Servcorp founded in 1978, and London-listed IWG plc (formerly Regus) founded in 1989, provide some insights into the operating history of the industry. Not surprisingly, the performance of the listed operators has been highly cyclical3 with EPS declining 95% and 45% respectively in 2009-10 despite relatively modest declines in occupancy.

EPS history – IWG and SRV

Source: Company reports, 2018

The operator’s largest expense item is typically the rent they pay to landlords, usually in the order of 50% to 60% of revenue (implying a mark-up of approximately 60% to 100% of their own rent for the ‘raw’ space). The next largest items are staff and other services expenses, which account for approximately 30% of revenue, leaving an EBITDA margin of circa 10%–20%. Depreciation (of expensive fit-outs) and tax reduce net profit margins to circa 5-10%.

Industry incumbents have been recently been disrupted by a number of new entrants, the highest profile being WeWork. Founded in 2010, the company is generously funded by venture capitalists with its largest investor being Softbank’s Vision Fund. WeWork has grown exponentially in just eight years to now operate from over 370 locations in 73 cities with over 220,000 members. WeWork accounted for 76% of flexible office space leasing activity in the US in 2016-174.

Members rent desks for about US$500 a month (depending on location). They share access to communal areas such as kitchens and games lounges. This encourages interaction while allowing WeWork to cut back on desk size. The US industry standard office space per person is just under 200 sq ft. WeWork provides about 60-80 sq ft.

Financial data on the fast growing privately owned newer entrants is opaque but many are not yet profitable. Disclosures included in its recent bond issuance reveals that WeWork made a loss in excess of US$800m in 2017, and negative EBITDA of almost US$200m. The company reports an ‘adjusted’ EBITDA margin of circa 6% which excludes material costs associated with its expansive ‘growth investments’, but it is clear that its dramatic absorption of office space (up to 100,000 sqm of space per month across 170 cities) is dependent on generous funding from private equity backers.

It is reasonable therefore to be cautious about the tenant credit of such fast-growing, profitless companies in an operationally leveraged business with relatively short corporate history. Despite their aggressive growth, REIT exposure to WeWork is relatively modest and not disproportionate to the overall market exposure.

Source: Company Reports, May 2018

We view the rise of co-working as partly cyclical and structural. The cyclical element is a concern to us as investors with a downside protection bias. We are cautious whenever we observe rapid demand from one particular segment of any industry – particularly when the incremental demand is being predominantly driven by occupiers with short and profitless operating histories.

The structural shift to co-working is less of a concern for us. Flexibility in the way organisations lease office space is likely to be the new normal. Landlords must adapt. We believe larger scale landlords with sound operating platforms are best positioned to win market share by providing space to traditional tenants who want flexibility, to co-working operators, as well as selectively offering their own version of flexible office leasing. However, whether many of the latest crop of share office operators can perform through cycle remains far from clear.

1 SPAC Special Purpose Acquisition Company … effectively a cash box established to take private companies public quickly without the long process of a traditional IPO

2 JLL Research “Bracing for the flexible space revolution” 2017 (among leasing transactions greater than 20,000 sqft)

3 The decline in share prices of the listed incumbents since 2016 reflects the disruption caused by new entrants. IWG’s recent rebound reflects M&A activity.

4 JLL Research “Bracing for the flexible space revolution” 2017 (among leasing transactions greater than 20,000 sqft)

Disclaimer:

Resolution Capital Limited ABN: 50 108 584 167 AFSL No. 274491

This communication was prepared by Resolution Capital Limited (“Resolution Capital”). The information in this communication is for general information purposes only. Information in communication is not intended as a securities recommendation or statement of opinion intended to influence a person or persons in making a decision in relation to investment. This communication has been prepared without taking account of any person’s objectives, financial situation or needs, and because of that, reliance should not be placed on the information in this communication as the basis for making an investment, financial or other decision. Any opinions or forecasts reflect the judgment and assumptions of Resolution Capital and its representatives on the basis of information at the date of publication and may later change without notice. Any projections contained in this communication are estimates only and may not be realised in the future. Returns from investments may fluctuate and past performance is not a reliable indicator of future performance. Resolution Capital believes the information contained in this communication is reliable, however no warranty is given as to its accuracy and persons relying on this information do so at their own risk. Unauthorised use, copying, distribution, replication, posting, transmitting, publication, display, or reproduction in whole or in part of the information contained in this communication is prohibited without obtaining prior written permission from Resolution Capital Limited.